My first financial investment product 20 years ago was an insurance policy. This was before the advent of fintech, which has made financial investment accessible to more and more people. Today, financial investment apps enable anyone to easily start, track and grow their investments, all through an app.

If you’re a beginner investor and would like to start small, read on to see how you can begin investing with as little as S$100 on moomoo. Plus, there are special promotional rewards for all users available until 31 May 2022.

Investment app for all levels of investors

Moomoo is an investment platform by Singapore-based Futu Holdings. Since entering the Singapore market, it has proven a hot favourite among the investing community; the user base has grown to 220,000, of which 100,000 are paying clients.

The fintech platform offers a whole range of products for trading or investment:

- Trading of US, Hong Kong and Singapore stocks without commission (only during the promotion period)

- China A-shares

- Margin trading

- US stock options

- American Depositary Receipts (ADRs)

- IPOs, Exchange Traded Funds (ETFs)

- Real Estate Investment Trusts (REITSs)

- Futures

- Mutual funds

If you’re above the age of 18 and have a bank account based in Singapore, you can open an account with Futu Singapore.

If you’re a new or beginner investor who is undecided on what to invest in, Managing Director of Futu Singapore, Gavin Chua, suggests looking into mutual funds. He says, “As a beginner with a limited investment budget, purchasing mutual funds in smaller denominations enables participation in investments. Mutual funds also provide the easiest way to achieve diversification while ensuring liquidity.”

He adds that funds are equipped with managers who can actively manage the funds (coupled with information disclosure due to strict regulations by the Monetary Authority of Singapore).

Fintech investment app with educational resources

Moomoo’s aim, says Gavin, is to make investing smarter, easier and more accessible to both new and seasoned investors; “The wealth management platform champions inclusivity and financial literacy.”

The company also understands that newbie investors require resources to aid their financial investment decisions. So, there are more than 300 videos on investing as well as infographic courses, guides and webinars on the fintech app. The topics cover stocks, options, funds and other financial instruments while catering to diversified learning objectives.

There’s also an in-app social community allowing investors to connect and exchange market views and investment insights.

“Seasoned investors can share their portfolios, experiences and insights with other investors from around the world,” says Gavin. “New investors are then able to decide on their investments and allows them to attain a rounded experience that’s a balance between studying about investment and engaging in the process of investing.”

According to Gavin, to help investors “level up”, the fintech app has tech-driven features including an AI-powered market monitor to track volatile stocks, advanced charts with technical indicators and drawing tools, custom alerts and indicator movements.

Fintech wealth management platform

As an investor grows in their financial investment journey, they may wish to manage their trading and investments all in one place. Moomoo enables users to do so via Money Plus, its online wealth management service.

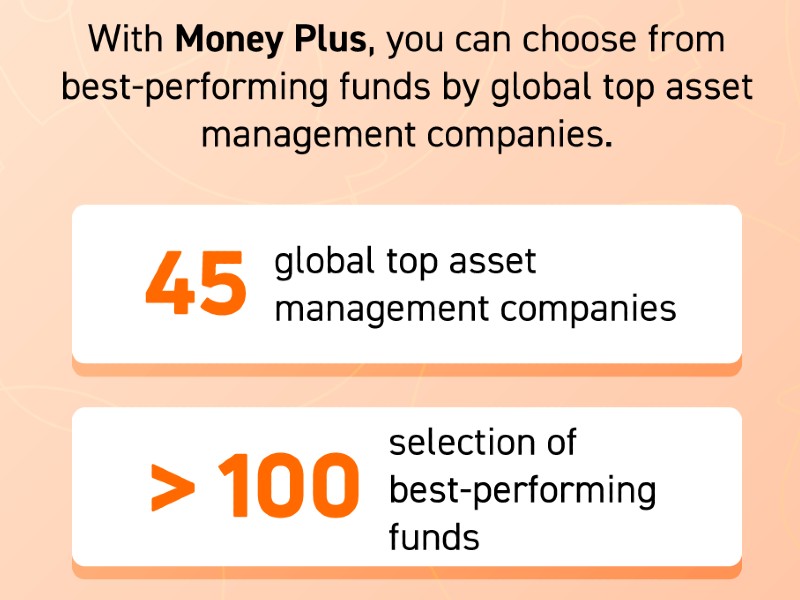

“Money Plus provides one-stop access to a diverse array of over 60 fund products ranging from equity, bond, dividend or balanced funds from global fund houses with 20 asset managers. Some of these include BlackRock’s BGF ESG Multi-Asset, Franklin’s Franklin MENA Fund and Lion Global Investors’ Lion Global Vietnam Fund, all of which have shown high annual returns year-on-year,” says Gavin.

Get rewarded when you begin your investment journey

Currently, there are zero fees on all funds with moomoo – the management fee is deducted from fund assets. And, as long as you’re above the age of 18 years and have a bank account in Singapore, you can open an account.

Promo 1

From now until the end of 13 April 2022, new sign-ups who make a deposit on the app and complete the necessary steps will receive one Sea Limited share and a S$30 stock cash voucher.

Promo 2

From now until the end of 31 May 2022, a moomoo user can look forward to earning the following reward points when they complete fund-related tasks in the app:

#1 On your profile tab, go to Task Center and complete the tasks to get a 15% fund coupon that generates additional returns for three days and 800 reward points.

#2 Set up an automatic investment plan and get a 15% fund coupon that generates additional returns for three days and a S$8.80 cashback coupon.

#3 Subscribe to a non-money market fund with more than S$100 and get a 15% fund coupon that generates additional returns for three days and S$5.80 stock cash coupon.

#4 New users who complete the above three tasks can unlock an exclusive gift package that includes three 15% fund coupons that generates additional returns for three days, 1,500 rewards points and a S$18 fund cashback coupon.

Reward points can be used to exchange for coupons and brand merchandise in the Rewards Club in-app.

Read this if your wondering where to live in Singapore or looking for the best restaurants in Singapore to eat at.

Don't miss out on the latest events, news and

competitions by signing up to our newsletter!

By signing up, you'll receive our weekly newsletter and offers which you can update or unsubscribe to anytime.