People regularly reach out to Avrio Wealth and ask them to help organise and optimise their financial life. This might include investments, insurance, tax, college savings, estate planning and more. One common request, especially amongst employees in Singapore, is for help with stock compensation in the form of stock options, restricted stock units (RSUs) and employee stock purchase plans (ESPP).

Equity compensation can play an integral role in helping you achieve your financial goals – and it’s important to plan properly to maximise its value. Daniel Weiss at Avrio Wealth runs through the basics here.

Stock Options

- Gives you the right (or option) to buy a certain number of company stock shares at a set price determined on date of grant (grant price or strike price).

- Pre-tax value is the difference between current stock price and grant price, multiplied by the number of shares (see the example below).

- Taxed as ordinary income upon a “trigger” (for example, exercising options).

- Has the reputation of more risk and more potential for return as they are leveraged. If current stock price is less than the grant price, the options are “underwater” and are worthless.

- Vesting typically occurs annually over several years (for example, 25% per year over four years) and they expire after a certain amount of time (e.g., 10 years).

Restricted Stock Units (RSUs)

- Gives you a certain number of company shares determined on date of grant.

- Always has intrinsic value, provided the company is solvent. If stock price is less than the price on date of grant, the value will be less, but they still have value.

- On date of vest, you receive shares, and they are taxed as ordinary income.

- They can vest annually over several years or on a “cliff” (for example, 100% after three years).

Employee Stock Purchase Plans

- Enables employees to buy company shares through payroll.

- Some employers offer a discount to make participation more attractive (for example, a 15% discount from market price).

- By holding stock for a certain amount of time, you can sell at favourable tax rates. Even if you sell immediately, on an after-tax basis, the gain might be 10% or more.

5 considerations around employee stock

While employee stock can help you achieve great wealth (just look at Google and Apple over the last 10 or so years!), it’s important to have a plan in place to make the most of it and avoid risk.

#1 Leverage

As mentioned above, stock options are leveraged. This means, for example, that a 10% change in Apple’s stock price can have a 20% or 30% change in option value.

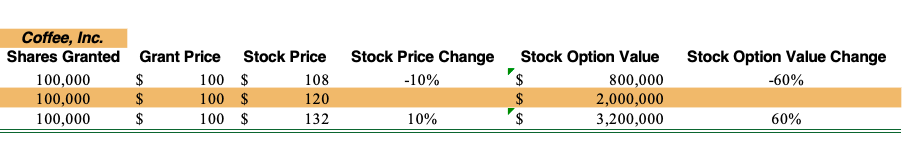

Example: In 2016, Marilyn was granted 100,000 shares of Coffee, Inc. stock options. Let’s assume the grant price was $100 per share and the stock price has increased to $120 per share. The value of the options is $2,000,000. If the stock price increases 10% to $132 per share, the option value increases to $3,200,000 (60% change). However, if the stock price decreases 10% to $108 per share, the option value decreases to $800,000 (-60% change). This 10% change can mean a $1,200,000 difference in value!

So, leverage can lead to magnified increases or decreases in value.

#2 Concentration

As the saying goes, concentration builds wealth, but diversification preserves it. Owning a concentrated stock position can build great wealth – just look at Elon Musk. However, it’s also important to ensure that the success of your wealth plan doesn’t solely rely on the performance of one company, particularly one that your income and benefits are also tied to. Diversification allows you to “spread your eggs across multiple baskets”, which can maintain wealth over the long term.

#3 Time Horizon

When do you need cash? Do you have plans to buy a house on the Spanish coast in a few years? Is your eldest child starting to apply to colleges with a $50,000-per-year price tag? Dedicating stock awards to specific goals can give you direction on when to exercise options or sell vested RSUs and employee stock.

#4 Tax

There are only two certainties in life: death and taxes! If you’re living in the US, there is typically automatic withholding when RSUs vest or stock options are exercised. (For example, when 100 shares of Apple RSUs vest, 30 shares are automatically withheld for taxes, and 70 shares are deposited into your stock plan account.) However, for expats in Singapore, there is generally no automatic withholding, which can result in a big and unexpected tax bill due next year.

Additionally, if you’re planning on moving from Singapore, expect to pay tax on unvested stock compensation to IRAS. The logic being, you earned the compensation while working here, you should pay tax on it here. This can also result in a big and unexpected tax bill! Proper planning and analysis can help prepare you for these liabilities.

#5 Value Captured

When is a good time to exercise stock options? This is often a difficult question to answer, as the value of stock options is determined by several factors including grant price, current stock price, time until expiration, risk-free rate (the theoretical return rate of a zero-risk investment), dividend yield, and stock volatility (Black-Sholes methodology). A good target is to capture 90%-plus of the full option value before exercising, depending on other factors.

Final word

While this is not an exhaustive breakdown on stock compensation and its considerations, it should provide you with some direction on how to think about your stock to maximise its value for your goals. As Dale Carnegie said, “An hour of planning can save you 10 hours of doing.”

To learn more about how to plan for tomorrow, please reach out to one of our wealth planners. Avrio Wealth has sophisticated equity compensation planning tools to help you make informed decisions.

Set up an online consultation to see if Avrio can work out a long-term solution for you.

Brought to you by Avrio Wealth Pte Ltd

9 Battery Road, #28-01

6240 6865 | avriowealth.com

This material is intended for educational and informational purposes only. It is not intended to provide specific advice or recommendations for any individual. Additionally, you should consult with your Financial Advisor, Tax Advisor, or Attorney on your specific situation. The views expressed in the material are that of the author and do not necessarily reflect those of any market, regulatory body, State or Federal Agency, or Association. All efforts have been made to report or share true and accurate information. However, the information may become materially outdated or otherwise rendered incorrect due to subsequent new research or other changes, without notice. The author nor the firm are able to always verify the content from third-party sources. For additional information about the firm, visit the MAS Website at mas.gov.sg and the SEC Website at adviserinfo.sec.gov. For a copy of the firm’s ADV Part 2 Brochure, contact us at info@avriowealth.com.