If you’re an expat in Singapore or simply have family living overseas, chances are you’ll need to send money abroad. There’s no shortage of remittance services in Singapore. However, these can sometimes be confusing to use, or they charge percentage-based transfer fees. Transferring money overseas regularly to children studying abroad, or to add to retirement or investment funds can, frankly, be a hassle. Singtel Dash is a convenient all-in-one solution that allows you to send money overseas through an intuitive money transfer app that will be familiar to anyone who has used online banking services in Singapore.

Singtel Dash allows you to make money transfers to over 35 countries

When it comes to remittance services, one of the key considerations is if a money transfer service sends money to a particular country. Singtel Dash allows you to remit overseas to over 35 countries. These include Australia, France, Germany, Italy, United Kingdom, South Korea and more.

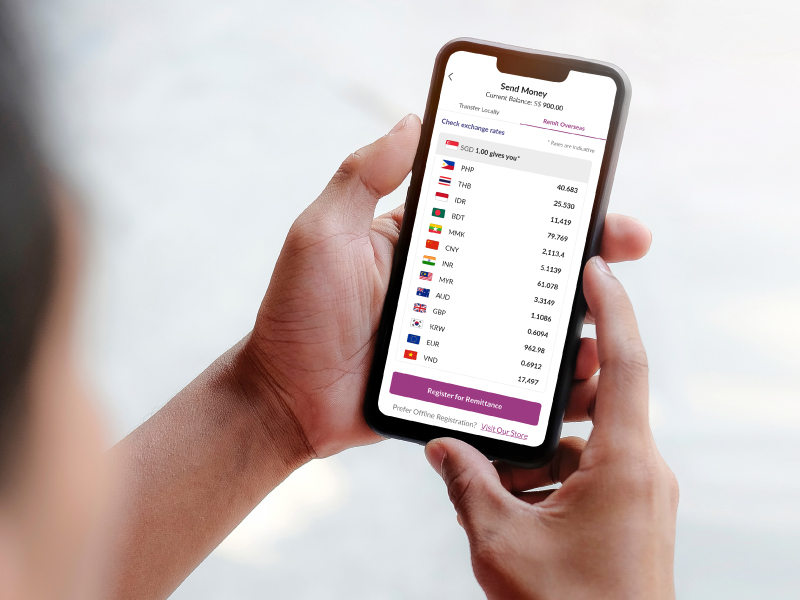

An easy-to-use app with affordable flat fees and competitive exchange rates

Overseas transfers often involve large sums of money so it’s important for a remittance app to have an intuitive interface. This minimises your chances of making a mistake. The Singtel Dash app offers an easy-to-use design that will be familiar to anyone who’s used app-based banking services in Singapore.

Additionally, Singtel Dash offers competitive exchange rates and affordable flat transfer fees rather than percentage-based fees. This is especially important if you’re regularly sending large sums of money overseas to pay for university fees or to top up retirement and investment accounts. For example, remittance to Australia, supported European countries (including the United Kingdom) and South Korea, incurs a flat fee of just $4 per transaction.

Transfer funds in less than a day

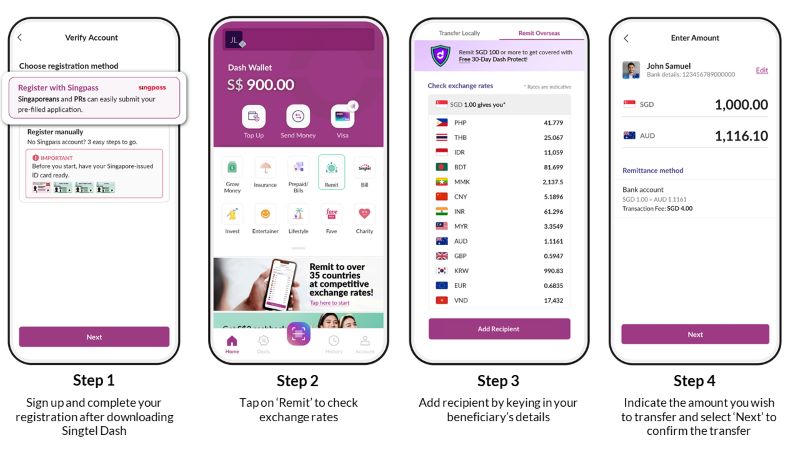

Creating an account and getting approved on the app is a quick and simple process. You only need a Singapore-issued phone number and your Singpass details. Alternatively, you can get your account approved manually (in up to two working days) by providing a photo of your NRIC, Work Permit, S-Pass or Employment Pass and a selfie along with proof of address (telco or utility bills). Once approved, you can make bank transfers to the United Kingdom, South Korea and banks on the instant transfer scheme in Europe, as well as New Payment Platform enabled accounts to Australia in less than a day.

Make money transfers overseas with peace of mind

Singtel Dash’s services are provided by SingCash Pte Ltd and licensed and regulated by the Monetary Authority of Singapore. This ensures that stringent security measures are in place. In addition to following strict licensing requirements, this money transfer app offers multiple support touchpoints. Customer service can be reached via the hotline or WhatsApp or by visiting their retail outlet along Orchard Road. This means that you’ve always got access to help when you need it.

Download the Singtel Dash app and get started in four steps

Setting up an account to transfer money overseas is a breeze. Simply follow the steps below and you’ll be ready to transfer money in less than 24 hours (if using automated approval with your Singpass). New users will enjoy a S$3 cashback* on the first remittance transaction – no minimum amount required.

Singtel Dash can be downloaded through the App Store and Google Play. For more information, click here.

*S$3 cashback is available for (i) new users who sign up for Dash during the promotion period and perform a first minimum remittance transfer via the Dash app within the first 60 days of sign-up and (ii) existing users who make a first minimum remittance transfer via the Dash app during the promotion period (valid till 30 June 2023 at point of publishing). Exclusions apply. Subject to terms and conditions.

This story was written in collaboration with Singtel Dash.