Looking for a fuss-free way to transfer money? DBS Remit is an all-in-one platform to make international money transfers from your mobile with zero fees (you read right!), same-day transfers and zero anxiety. Plus, it can be done via a single app – the DBS digibank app.

Covering over 50+ destinations, DBS Remit has a wide reach too, so you can send money to your loved ones no matter where they are. DBS Remit is the game-changer that ticks all our boxes. We downloaded the DBS digibank app and took DBS Remit for a spin. It was an eye-opener.

How it works

How it works

Not all mobile apps are created the same. Some banks require you to log in using a computer because some functions are not available on their mobile apps. DBS Remit on the other hand, is built within the DBS digibank app itself and that is the difference between riding that cactus and sipping martinis on a beach.

The worst part about remittances are international fund transfer charges, several in fact, on each remittance. However, with DBS Remit, there are no transfer fees and the money lands in the recipient’s bank, usually immediately, or within the same day. Like the conspiracy theorist you are, maybe you think that they’re in a padded exchange rate. The exchange rates are competitive enough that we don’t shop around anymore. The app is a breeze to use, even for the non-techie. Aside from the rocky road of transfer fees, there were several other problems with the banks we had been using before DBS Remit swept us into the fast lane.

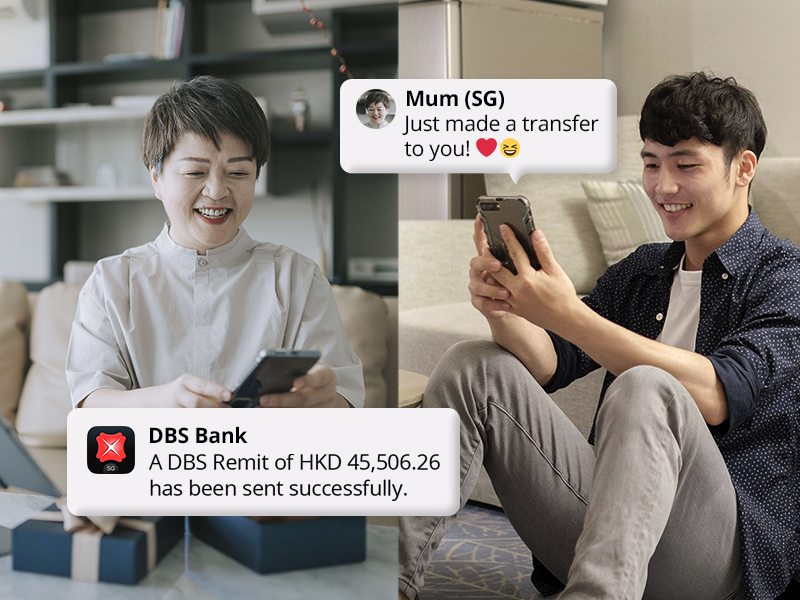

DBS Remit’s zero fees mean we no longer overthink how much we can send to our children or parents abroad. It reflects the exact amount remitted in your choice of currency via the DBS digibank app, with no further fees tagged on at a later stage. That’s just how they roll. And you don’t even have to switch between apps. You can easily do international money transfers directly from the DBS digibank login page.

Same-day transfer makes it effortless and stressless. You never have to worry about sending emergency money back home! Want to keep track of your transfer status? The live-tracking function is available to DBS recipients in Hong Kong and India and this allows you to know exactly where your money is, so you never have to lose sleep thinking about your payment status.

Getting started

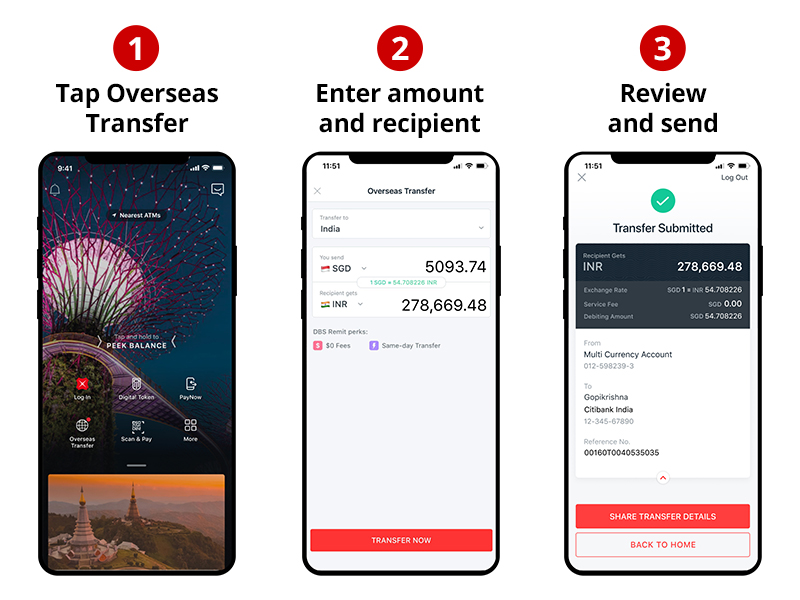

If you don’t already have the app, download the DBS digibank app like you would any other. Open sesame and let the DBS genie do the rest. You will need to know your DBS banking details, of course. Anyone can do this – we’re oldies and it was effortless. Three steps is all it takes to remit money straight from the DBS digibank app.

It’s this straightforward! Open the app, tap Overseas Transfer, enter the amount in the preferred currency, select the recipient, review and send.

Tip: Add recipients you regularly send money to so you won’t have to repeat the same steps. All you need is the recipient’s bank account details. You will receive push alerts about your transaction and when it has been completed. In our experience, it all happens in minutes. All you need to do next is share your payment details with the recipient via WhatsApp to keep them informed about the payment status. It is that seamless!

It’s about time we got onboard DBS Remit – zero fees, same-day transfer, zero anxiety (think cactus versus martini).

Find out more about DBS Remit and make your first international money transfer.

No DBS Account? Sign up for an account now!

How it works

How it works